New empirical evidence for the subgroup of 13 EU members shows that electricity distributive losses and electricity intensity lead to a reduction of 8.7% and 3.8% on output and manufacturing aggregate value.

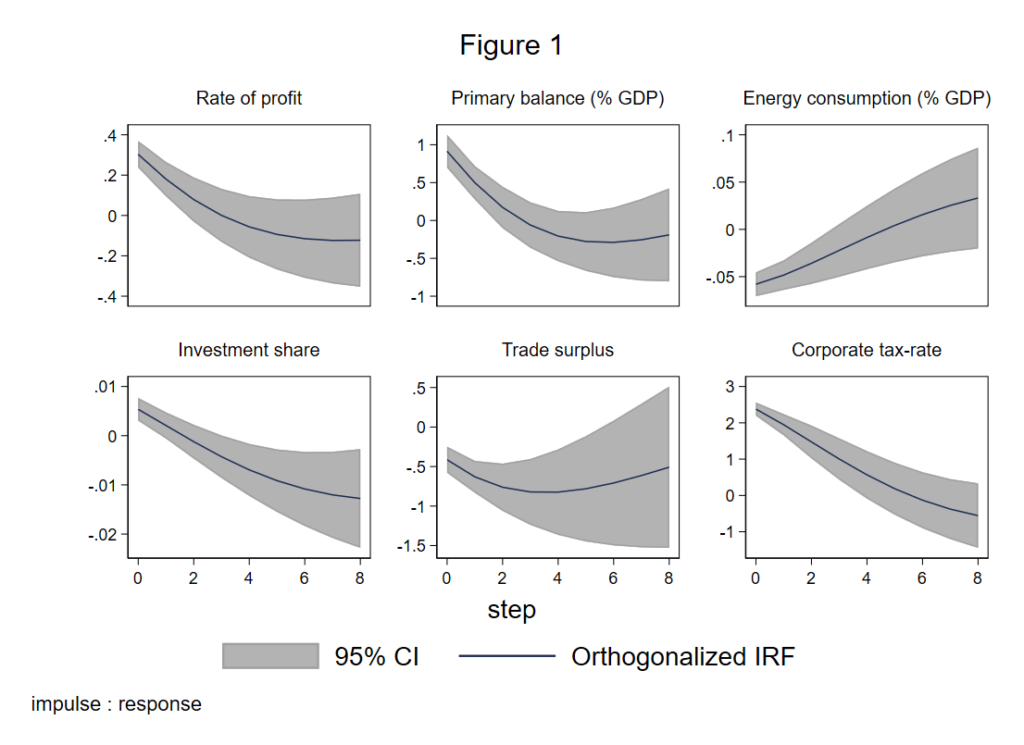

Using data from 1992 to 2018, I augment the standard Kaleckian equation of: profit rate, investment share, government primary balance % GDP (as a proxy of budget deficit) and trade surplus of goods and services (% GDP) with corporate taxes and primary energy consumption (% GDP). The equation is indirectly related to the capital-output ratio through the technology and the use of factors. Thus, the future stream of firm’s profit is affected. In Figure 1 Impulse-Response-Functions (IRF) indicate an heterogenous response in the short-run within group as a result of common shocks and breaks. In other words, results show that an increase in corporate taxes for EU-Western members has a negative effect over the primary balance, profit rate of the economy, investment share, trade surplus and primary energy consumption four years after the initial shock (i.e., 2022). For those who are not familiar with econometric tools, the VAR approach is atheoretical; thus, all variables are related and causality runs in both ways. Putting the discussion onto the actual political context, results suggest that policymakers in Western EU countries should consider an integral tax-reform with cuts —where the average tax-rate is 30.4%— coupled with “big push” demand side policies to compensate the additional expenditures on energy imports and revert the negative effect of taxes over the profit rate. Certainly, this will initially require substantial fiscal efforts in terms of forgone revenues, but as explained earlier, electricity losses may undermine even more manufacturing firms export capacity or worse trigger a debt overhang crisis along with stagflation for the next 5 years.